How Outsourcing Accounting Can Improve Your Bottom Line

Financial management of your business is not all about balancing books but it is all about using financial information to make better decisions and to drive your business. This is where outsourced accounting can be used. Outsourcing of accounting has become a trend and many companies no longer outsource accounting as a cost cutting measure. […]

The Role of Accounting in Business Growth and Expansion

Accounting in the modern business environment is no longer a matter of adding up numbers and paying taxes. It has become an effective strategic instrument that enables decision-making, mitigates risks, enhances cash flow, and leads to sustainable growth. Smart accounting can make or break a business, whether you have a startup or an established business […]

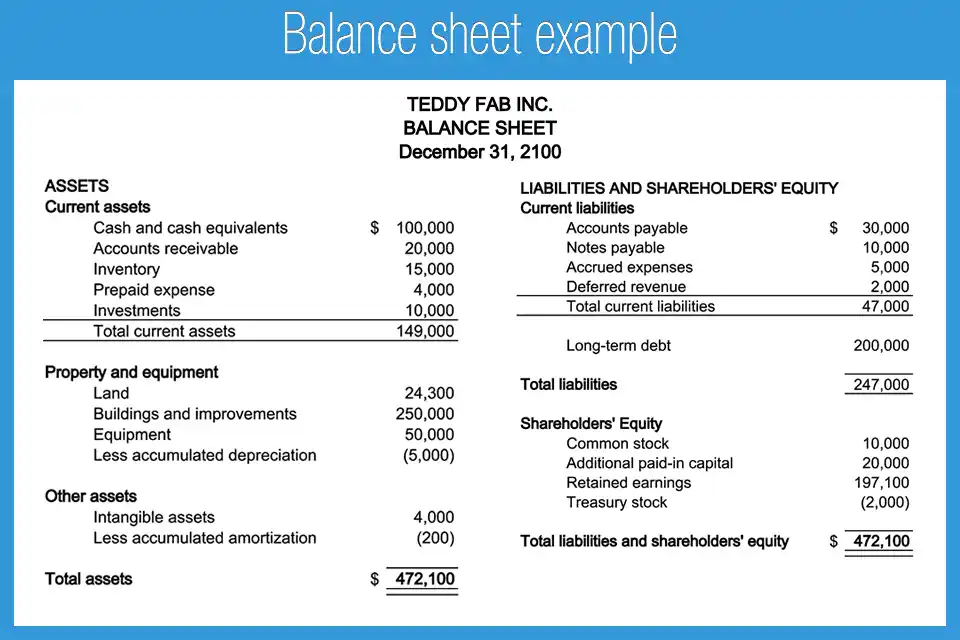

Understanding Financial Statements and What They Mean for Your Business

Accounting statements are necessary tools that give an in-depth overview of the financial performance and stability of a company. As an investor, a business owner, a creditor or just a person who wants to know the financial position of a company, being able to read and understand financial statements enables you to make informed decisions […]

How to Set Up an Efficient Accounting System for Your Business

To survive in the contemporary business world, more than just an idea and a good product is needed: they also need to be correctly and efficiently manage finances. Starting a new business or expanding an existing one, a proper accounting platform can either make or break your business. It is not only about expenses tracking […]

Why Accurate Financial Reporting is Crucial for Your Business

Proper financial reporting is the basis of intelligent business decision making, investor trust and growth in the long term. As a small business owner, a startup founder, or a finance executive in a large firm, you will need powerful financial reports to know how your company is performing, manage its cash flow and remain compliant […]

How Tax Planning Can Save Your Business Money in the Long Run

In this modern, fast paced business environment, tax planning is not only about avoiding IRS penalties, it is a wise financial decision that directly enhances your bottom line, preserves your assets and generates long term business development. With the tax laws in the U.S. constantly changing, as are the corporate tax rates, the IRS compliance […]

Navigating International Tax Laws for Expanding Businesses

Taking your business into a new country allows you to embark on a potentially massive expansion, but along with it, you get a whole net of tax regulations and reporting requirements that can be tricky to work out. As a U.S.-based company that is expanding to other countries or an international business entering the U.S. […]

Smart Tax Planning for Entrepreneurs: Strategies to Save Big and Stay Ahead

In 2025, savvy entrepreneurs realize that tax planning is not a one-time-a-year requirement, but a 12-month process to gain wealth, shelter profit, and remain compliant. The expiration of some of the provisions of the 2017 Tax Cuts and Jobs Act (TCJA) is approaching at the end of this year, so this is the best time […]

How to Build a Legacy with Effective Wealth Management

It is something that we all dream of leaving behind something, a legacy, that will show our hard work, our values, our achievements. However, creating a legacy is not all about wealth accumulation, but also about how you manage your wealth so that it not only works in your favor, but also in the favor […]

Understanding the Role of Wealth Management in Achieving Financial Freedom

Financial freedom is one of the dreams that many people have, yet it may seem to be a distant dream. It can be daunting, whether you are a young professional at the beginning of your career, a family that wants to secure your future, or an entrepreneur who wants to get rich in the long […]